What is a Sales Budget? Definition, Examples, And How to Create One

- September 23, 2022

A sales budget is a financial plan that lays out how you expect to sell your products or services.

It typically includes information about total sales for the period, cost of goods sold, marketing expenses, and sales team salaries. The budget also focuses on forecasting expenses against potential revenue streams, so it can be a helpful tool when determining whether you should invest in additional resources to support your efforts.

The finance department will then use this information to decide purchases and staffing needs to meet demand during busy periods (like back-to-school shopping).

Sales budgeting also allows businesses with seasonal product lines or fluctuating demand curves, such as retailers, restaurants, and professional services firms, an opportunity to ensure they have sufficient resources available at all times. It also helps them make sure costs remain under control.

When is a Sales Budget Prepared?

You’ll need to decide how often you want to prepare your sales budget.

Some businesses prepare it once a year, while others plan for their future sales every quarter or month.

There is no right or wrong answer here. It depends on the nature of your business and what you want to get out of your sales budget.

Some companies who model their sales budget once a year may look at that data monthly and make changes based on current trends and historical performance.. Other organizations will build annual, quarterly, and monthly budgets simultaneously so they can see how they contribute to each other over a year.

The most important thing is consistency, and making sure your information is complete and accurate. Without ensuring that you have the right information, your sales budget can have holes and be inadequate.

Knowing your return on sales and succession rates on your yearly/quarterly targets in the past will allow you to make sure your budget is correct for your company.

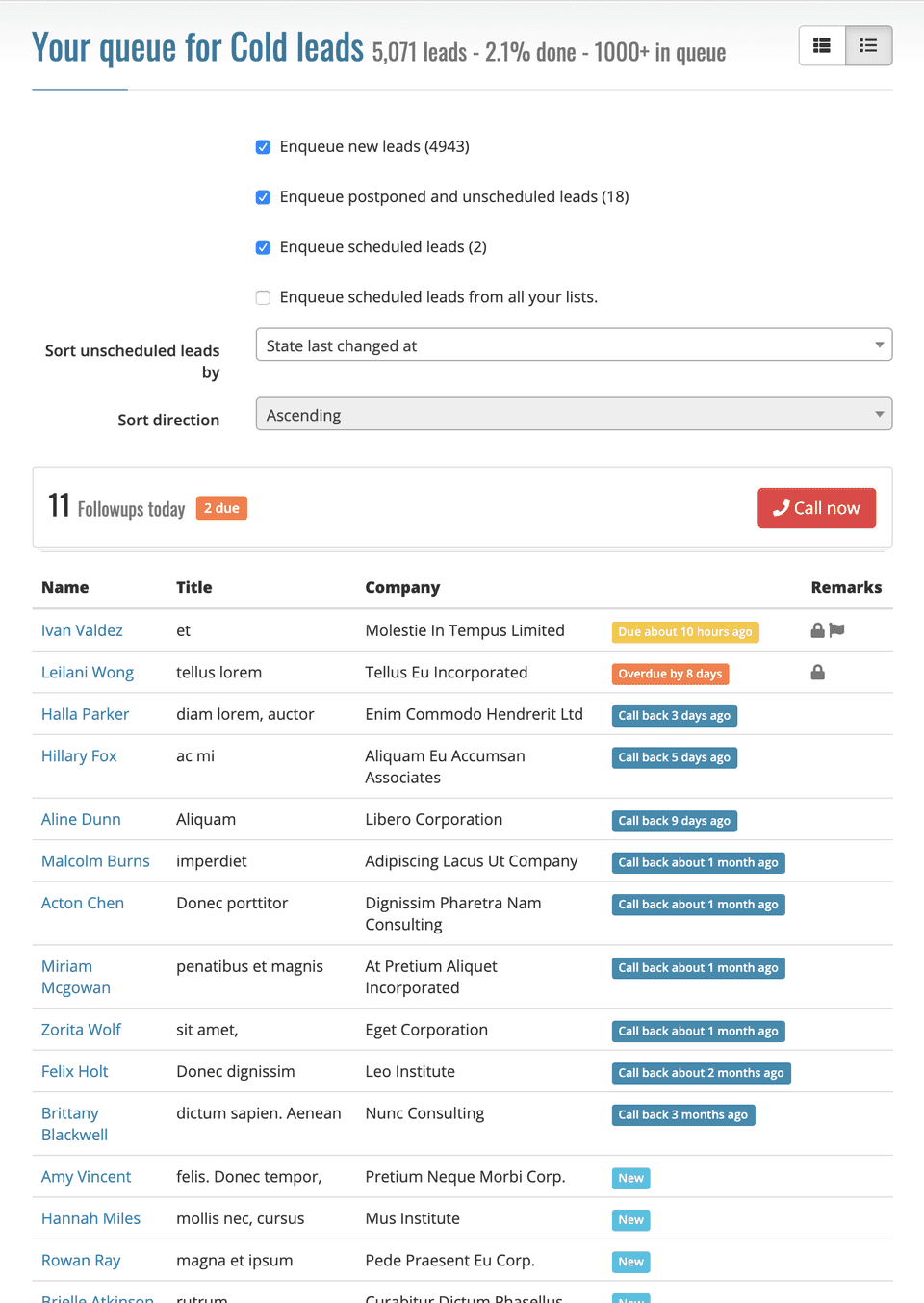

Myphoner’s campaign activity report can help keep track of your business’s progress and trends, all in a user-friendly interface. Making your budgets and reports has never been so easy, with all the information you need in one place!

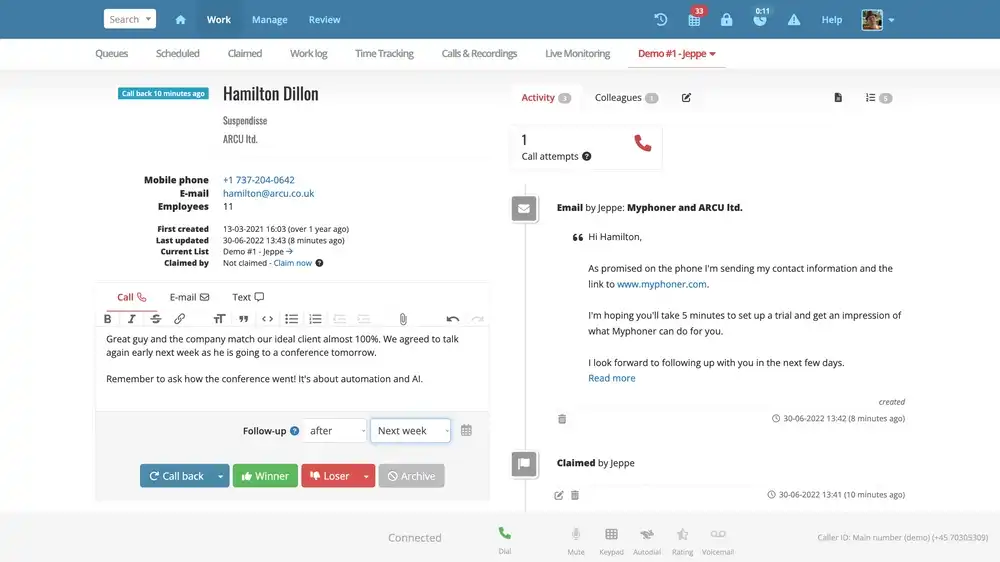

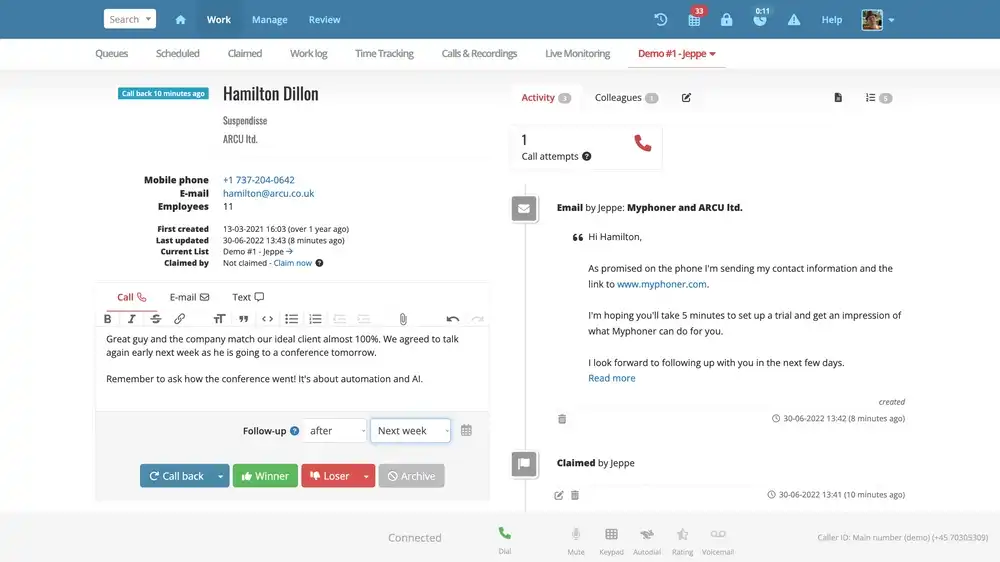

Our Lead Routing feature allows cold callers and managers to sort incoming leads based on priority.

Agents can claim leads - either manually or automatically - from a large pool, improving your sales teams’ overall resource utilization.

The lead queue will always provide agents with the most relevant lead to the agent, dynamically and distraction-free.

Quick pause to highlight Myphoner. Don't worry, your article resumes below.

Selling to undefined over the phone?

Use our sales dialer to call customers and prospects in undefined at the most competitive rates

What’s included in a sales budget?

Sales volume and price are the two components that make up your sales budget. The budget is a projection of the number of units and the amount you expect to sell at a given price.

This formula helps you determine how many customers you’ll need to meet your revenue goal and what price point will be most attractive to them.

To gather all the required information in your sales budget, consider it as collection points that span throughout your entire business plan.

Your sales budget must include;

- An income statement (also called a profit and loss statement). This is an overview of how much revenue you earn vs. what expenses you have in any given period (typically monthly or quarterly).

- A balance sheet or a snapshot of your company's assets and liabilities. This includes cash on hand, inventory value, equipment value, accounts receivable, accounts payable, loans/loan payments due dates, etc.

- A cash flow statement that covers historical costs and future predicted inflows and outflows of cash for up to one year.

Importance of a sales budget

If you've been on the fence about creating a sales budget, it's a good idea because;

- It gives you a clear picture of what you can expect to sell in the next year and how much profit you’ll receive. A sales budget also tells you how much inventory to order and how many employees you'll need. This will help ensure your business is appropriately stocked and staffed to meet customers' needs.

- It helps you plan for the future. While many factors may impact your business in any given month, such as holidays or seasonal changes, a sales budget helps identify trends so that month-to-month fluctuations don't negatively affect your bottom line. Your sales budget will predict slower months and busier ones based on seasons or industry trends, giving you time to prepare in advance.

- It helps you better control your business and keep costs low by identifying slow periods ahead of time. You can use those times as an opportunity to stock up on inventory or perform maintenance without having to deal with customers waiting around for service.

A step-by-step guide to creating a sales budget

Set your sales budget based on historical data and growth expectations.

The first step to building a sales budget is to look at your sales history and set your expectations for the future. If your company has been steadily increasing its sales year over year, you should expect that trend to continue.

On the other hand, if your company saw significant drops in revenue due to market shifts or other factors, you should expect those losses to be offset by growth in other areas.

If your company is dependent on a single product, you should anticipate its decline as the product becomes less popular and eventually dies out.

Once you have a good idea of how much money you're likely to make in the future, it's time to start figuring out how much of that money belongs in each department.

Define your sales targets.

Your sales plan should always start with clear goals. What do you want to achieve? You need to define these long and short-term goals for your sales team to understand their priorities and why those priorities matter.

Your targets could be:

- Attract a set number of new customers within the next quarter.

- Increase revenue by 10% year over year.

- Improve customer retention by 5% in the next month.

Start with a list of broad goals with specific deadlines, then think about how you'll reach them, and break down those strategies into achievable milestones that you can track to completion.

As your plans evolve, so will your budget needs, but setting clear goals at the beginning keeps everyone on task toward the same end goal and helps you avoid running out of runway halfway through the year.

Also, a clear goal allows you to evaluate your success when preparing your next budget — did you reach your goals during your last budget? Were your goals realistic? How can you make sure your goals are met/exceeded in this budget? Without a clear target, it’s hard to evaluate how well things went, and what can be improved for next time.

Create a sales plan

When you're trying to decide which methods to use to reach your sales goals, it can be hard to imagine how those different methods will fit together.

A sales plan is a tool that outlines the strategies and tactics of your marketing and sales team. It should include things like;

- Your strategy for reaching revenue goals

- Any challenges or opportunities you see in the marketplace

- The tools that will help you along the way (like new CRM software), and how those tools help solve problems for your team

- What tactics you’ll use to execute against these strategies (like email drip campaigns)

- A summary of how each tactic will contribute to achieving your goals

- How much revenue each tactic will bring in over a specific period

Monitor and adjust your budget as needed

You're almost done with your sales budget—but there's one more step!

Now that you've come up with your budget and started tracking your expenses, it's time to monitor and adjust your budget.

You might find that you've overspent in some areas or under-spent in others. Or maybe you'll have a month where the number of leads you're generating is way off from what you expected.

That's okay! All of these things are part of creating a sales budget and making adjustments as needed.

If you need to make any adjustments, just go back to the beginning. See what happened? What could have been done differently? And remember: don't be afraid to use trial and error—it's how we learn!

Making stellar sales reports is crucial to keeping track of your success rate. Following your finances throughout your budget is imperative, and ensuring the information is organized and easily accessible is key to your success.

Use Myphoner’s Tools To Keep Organized

Time is money, and keeping your organizational skills in shape is important to be able to keep your budget efficient. By automating simple tasks, we can ensure that no time is wasted.

At Myphoner, we believe that staying ahead of the curve in organisation and automation can let your business truly shine. Cutting out all of the bulk, our lean, lightweight CRM can help make sure that your workflow is organised and clear.

A tidy workflow means that none of your budget is wasted on trying to navigate a chaotic system and can mean the difference between a business operating optimally and becoming a mess.

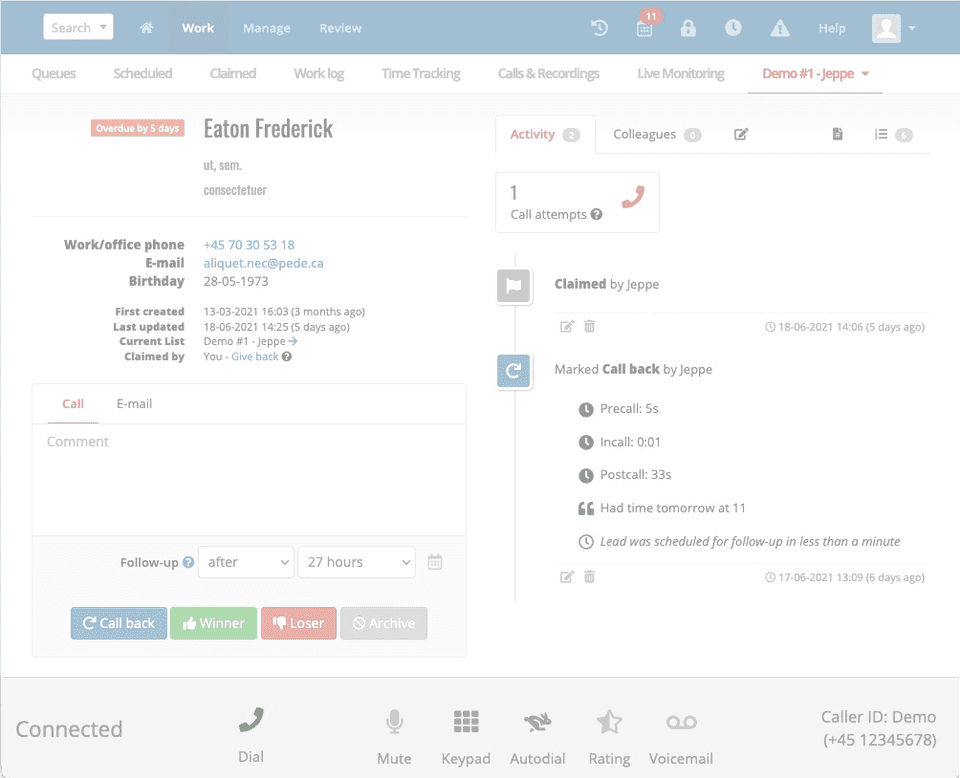

Myphoner’s Power Dialer helps speed up the time it takes for agents to make calls. You can seriously level-up your agent utilization using this tool, as we’ll ensure that at the end of every call, a new call is lined up instantly.

Your sales agents will be able to do a better job by eliminating hours spent dialing between voicemails.

Our Lead Router also massively helps organizations automate the process of handing out leads — making it simple, efficient, and as optimal as can be.

By allowing agents to claim leads from a large pool, and prioritizing the right leads, sales teams can ensure their budget is being used most effectively..

Personalized Outreach on Steroids

Measure your overall success by tracking key performance indicators (KPIs).

When you're trying to measure your overall success, the best thing you can do is track key performance indicators (KPIs).

These are the numbers that matter most when you're looking at the health of your sales department.

Here are some KPIs that should be on your radar:

- Your conversion rate is the percentage of prospects who become customers.

- Your average deal size—the amount of money that each customer brings in over time.

- The prospect-to-customer ratio—the number of new prospects divided by the number of customers you have. This can help you determine if you're targeting the right audience and if there's room for growth in your business model.

- Cost per lead—how much it costs to turn a prospect into a customer, including all expenses related to marketing campaigns and other advertising efforts to bring in new leads for salespeople to follow up with.

- Customer acquisition cost (CAC)—the total amount spent on acquiring each new customer, which includes both marketing costs and salaries for employees working directly with sales teams on attracting new clients through various methods like cold calling or door knocking at homes/offices where potential buyers live/work (either alone or together).

Example of a Sales Budget

We love sales budgets! They're the lifeblood of any business, and they're a great place to start if you're looking to improve your company's performance.

Here's an example of a sales budget:

Company name XXXX

Sales Budget

For the Year Ended December 31, 20XX

| Quarter 1 | Quarter 2 | Quarter 3 | Quarter 4 | |

|---|---|---|---|---|

| Forecasted unit sales | 7000 | 6,000 | 9,000 | 10,000 |

| x Price per unit | $10 | $10 | $11 | $11 |

| Total gross sales | $70,000 | $60,000 | $99,000 | $110,000 |

| - Sales discounts & allowances | $1,000 | $1,900 | $1800 | $2,000 |

| = Total net sales | $69,000 | $58,100 | $97,100 | $108,000 |

Bottom line

Making a sales budget sound intimidating, but it's the best way to track your lead generation efforts.

It provides you with a frame of reference to identify what does and does not work for your business. Also, keep in mind that it's okay to adjust your sales budgets as you learn more about how leads are generated for your business.

By organising and budgeting, you can improve upon your marketing initiatives and ultimately increase lead generation for your business!

So, ready to take your sales team to the next level? Try out Myphoner’s lightweight and efficient CRM today, and unlock your sales teams’ full potential!

Written by

Daniel Vincent

I'm Daniel! Head of Customer Success here at Myphoner. Over the past (almost) decade, I've worked with multi-national corporations as well as a handful of start-ups to transform their support experience into something truly exceptional.

At Myphoner, I spend most of my time trying to understand our client's experience and thinking of ways to improve it. My wish is for all our clients to be enabled to unleash the power of Myphoner within their businesses.

Related articles

Tools & Practices

Here’s How We Deal With Angry Customers on the Phone

How to Diffuse a Negative Situation on the Phone and Turn Angry Customers into Loyal Advocates

January 3, 2024

Industry Related

13 Staggering Cold Calling Statistics to Consider in 2024

Cold calling remains an important sales technique that, when done right, is hugely lucrative. Discover impressive statistics about cold calling in 2024.

January 2, 2024

Tools & Practises

Lead Recycling 101: Turn Old Leads Into Paying Customers

Don't count old leads as lost leads. Learn how to turn them into paying customers using an epic lead recycling campaign.

June 1, 2023