A simple way to calculate return on sales

- July 14, 2022

You know that feeling when you compute your yearly revenue, which is excellent, but you still feel like your business stagnates. But you just don’t know what’s the problem.

It’s one thing to generate revenue and another to make your business profitable.

You can be hitting considerable numbers in sales, but it doesn’t matter if your production cost is the same.

Soon enough, you won’t have enough cash in your business and risk joining 82% of businesses that fail due to a lack of cash flows.

For that reason, you need to keep track of your Return on Sales (ROS).

What is Return on Sales?

Return on Sales is also known as Operating profit margin, a ratio showing your business operation efficiency.

Typically, ROS gives you an overview of the profit you make per one dollar of sales revenue after subtracting operating costs like wages and raw materials.

The metric plays a significant role in determining the overall health of your business. This is because your business is headed for the danger zone when it's decreasing. And when it’s increasing, it means that your business is doing well.

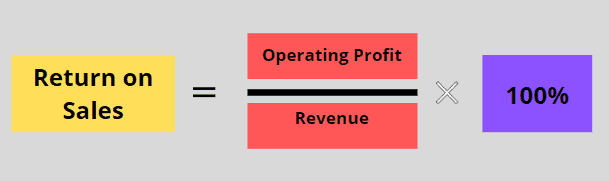

Return On Sales Formula and How to Compute it

As noted earlier, ROS is computed as a ratio that you can change into a percentage.

The metric is calculated by dividing your profit (before tax) with the general revenue from sales over a certain period.

Here’s the exact formula.

ROS = Operating Profit / Revenue

Where,

Operating Profit = Revenue - expenses

In your calculation, remember that ROS is calculated as earnings before interest.

So let’s see how the formula above applies in an actual situation.

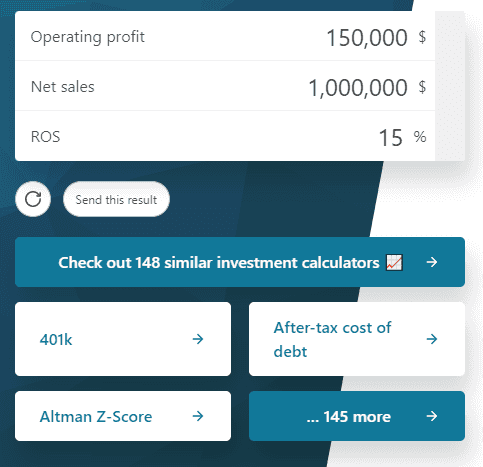

Suppose your B2B company earned $1 million in the first quarter of 2022. From the revenue, you incurred an operating cost of 850,000.

To get the ROS, you must first get the profit for the quarter, which in this case, is $1,000,000 minus $850,000. That gives us a profit of $150,000.

Then take $150,000 divided by $1,000,000. That gives you a healthy ROS of 0.15. Multiply it by 100 to get the percentage ROS of 15%.

That’s a good ROS as most businesses oscillate around 5-10%.

If you have a lot of figures and don’t want to do the calculation manually, you can use free ROS calculators like this one from Omni Calculator.

Why Should You Calculate Your Business ROS?

You don’t have to increase your product volume to make more profit. In most cases, your operating cost takes a chunk of your profit.

If your business brings around $100,000 in monthly sales, but it takes you $90,000 to make that, doubling your input will do more harm.

You’ll have to pay more for raw materials and overhead expenses. And there’s a high chance of failing to make twice the profit you’d anticipated.

ROS aims to show you those small loopholes that eat into your profit. If you see your ROS failing from month to month, it’s time to figure out how you can reduce expenses.

That said, here’s why you need to calculate your business’ ROS.

-

You can use the metric to benchmark with competitors and your industry in general. If your ROS is lower than 15%, you’re not performing well according to industry standards.

-

A bank might need to see your month-to-month ROS to know if you are eligible for a loan. A strong ROS qualifies you because financial institutions like to lend to companies that will be comfortable in repaying loans with the accrued interests.

-

Investors and other stakeholders also want to know how the business is performing. The ROS goes deeper than the revenue figures. It shows them where the company is headed and how much return they can make for their investment.

-

A yearly ROS calculation shows the financial performance of your company. The directors and interested parties know if the company can comfortably pay back its debtors and run smoothly without asking for more cash injections.

What ROS means to your Business Operation

You don’t stop after calculating your business ROS. The action you take is what determines how your next ROS will look like.

So in case your ROS is below the required industry standards, here are a few things you can do.

Cut down the Cost of Labor

This doesn’t mean you should go on a firing spree. It involves investing upfront so that you won’t have to hire more workers in the future.

For example, you can increase your sales reps salary and put them into sales training so they can work more efficiently.

As a result, you won’t have to hire more sales reps to hit your sales quota. When treated well, the small team you have can do a lot more than a hundred recruits.

Increase the Price of Your Product

You don’t always have to compete on price with your competitors.

Historically, businesses that competed on price never went well. For example, Rupert Murdoch, in 1990, slashedThe times newspaper aiming to throw their main competitor, The Daily Telegraph, out of business.

They started a war on pricing, which eventually left_The Times_recording a devastating effect on its profit margins.

So you don’t have to fear increasing your product’s price. A study conducted in 2019 found that consumers are 30% less price-sensitive, meaning they are less likely to abandon their favorite products and opt for cheaper ones.

But still, there are a few things to note.

First, don’t go overboard in increasing your product’s price. Your decision should be based on the volume of products you sell. For example, if you sell 100,000 units of the product every month, a dollar difference will add you an extra $100k.

Secondly, be ready to invest back the money you make from the price increase into the business. For example, you can invest more in marketing, increase the quality of your product or improve customer service.

Increase Your Product Sales

Increasing revenue is the first thing any business with a low ROS would want to do. Higher sales mean you’ll significantly make more revenue and more profit.

The only disadvantage of the strategy is that it gives you a false representation of your ROS. You’ll have to increase input like raw materials and overhead costs and hire more workers to hit your desired revenue.

In addition, increasing revenue is easier said than done. Acquiring new customers is a battle on its own. You must invest more in customer acquisition costs like email marketing, advertising, content marketing, and social media marketing.

Get Lower Priced Raw Materials

While you want to decrease your cost of raw materials, don’t make the mistake of using low-quality raw materials while keeping your product prices intact. You don’t want to tarnish your brand’s reputation.

Talking to your suppliers is the best way to decrease your raw materials cost. If you’ve worked with them for a while and have a strong relationship, you can ask if they’re open to negotiating a lower price.

Or you can check your production process to detect stages that waste raw materials and adjust accordingly.

ROS vs. Profit Margin

Many people use ROS and profit margin interchangeably. Here are the differences between ROS and the two main types of profit margin.

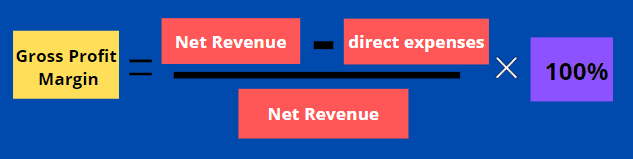

Gross Profit Margin

The Gross profit margin is a metric that tells you what your business made after you’ve paid your business’ direct costs like production costs, labor, and raw materials.

It’s the most critical metric in your business because you might have severe repercussions if your business doesn’t have a high gross profit margin.

The goal is to reach a break-even point where your revenue can cover your operational cost.

To calculate the Gross profit Margin, simply subtract the cost of goods from net sales or revenue and then divide it by the net revenue. You then multiply it by 100% to get the percentage gross profit margin.

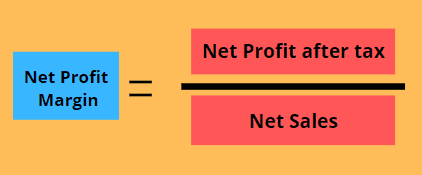

Net Profit Margin

The Net Profit Margin screens your business’ health. It shows how much after-tax profit you generate by each dollar. In short, the higher your net profit margin, the more money you have in your bank.

To calculate your Net Profit Margin, divide your company’s net profit after taxes by your net sales.

Conclusion

We couldn’t stress enough the importance of computing your business ROS. It’s critical as it tells you where your business is headed to. You can develop strategies to ramp up your production and marketing with these insights.

Written by

Jeppe Liisberg

Jeppe Liisberg is a forward-thinking entrepreneur and software developer who has built and contributed to multiple successful startups. With a philosophy centered on creating focused, specialized solutions that excel at solving specific challenges, Jeppe founded Myphoner after identifying a critical gap in the market for effective cold calling software.

"I believe that exceptional software should solve one core problem extraordinarily well rather than attempting to be everything for everyone," says Jeppe. "After years in the trenches as an entrepreneur, I couldn't find a cold calling solution that truly met the needs of small businesses and sales teams—so I built Myphoner to fill that void."

Today, Jeppe remains personally invested in Myphoner's success and customer satisfaction, personally welcoming new users and actively responding to feedback. This hands-on approach ensures that Myphoner continues to evolve based on real user needs while maintaining its commitment to simplicity, effectiveness, and affordability.

Connect with Jeppe on LinkedIn or reach out directly at jeppe@myphoner.com.

Related articles

Tools & Practises

The Complete 2023 Call Queues Guide and Tips for Improving Your Call Queues

Call queues manage incoming calls in businesses. Learn how to set up efficient queues with prioritization, time-based routing & custom greetings. Boost your CX!

April 27, 2023

Tools & Practices

Achieving Significant Results with Strategic Phone Follow-ups on LinkedIn

Learn how to boost LinkedIn campaign conversions to 40% or more: warm call follow-ups raised appointment bookings from 15% to 40% in a diverse industry case study

March 29, 2023

Tools & Practices

LeadFuze Review - Transforming the way you generate leads

Boost sales with effective lead generation using LeadFuze. Our guide explores what it is and how to use it effectively to identify potential customers with ease.

March 9, 2023